michigan sales tax exemption number

The Arizona Government website allows a user to search for the resale certificate using the 8-digit tax license number. Michigan does not issue tax exemption numbers.

Free Online 2019 Us Sales Tax Calculator For Michigan Fast And Easy 2019 Sales Tax Tool For Businesses And People From Michigan United Sales Tax Tax Michigan

CityLocalCounty Sales Tax - Michigan has no city local or county sales tax.

. While the Michigan sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. Transmittal for Magnetic Media Reporting of W-2s W-2Gs and 1099s to the State of Michigan. Sales Tax Exemptions in Michigan.

Because Michigan is a member of this agreement buyers can use the Multistate Tax Commission MTC Uniform Sales Tax Certificate when making qualifying sales-tax-exempt purchases from. Streamlined Sales and Use Tax Project. The state sales tax rate is 6.

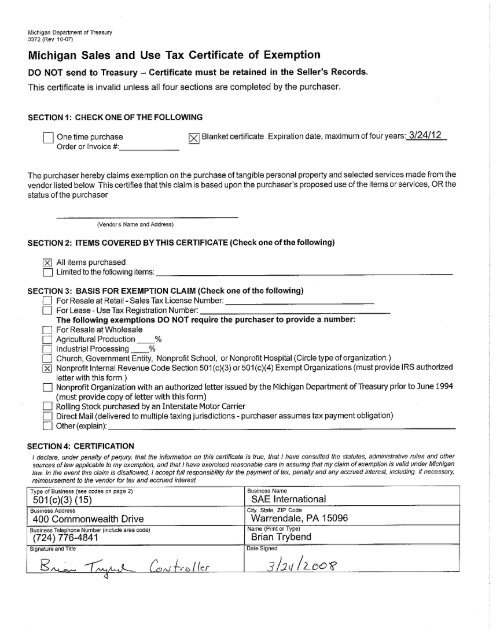

A Michigan tax ID number is a requirement for all businesses in the state of Michigan. Therefore you can complete the 3372 tax exemption certificate form by providing your Michigan Sales Tax Number. 3372 Michigan Sales and Use Tax Certificate of Exemption Keywords 3372 Michigan Sales and Use Tax Certificate of Exemption Created Date.

Michigan Federal Tax ID Number. The following exemptions DO NOT require the purchaser to provide a number. In order to register for sales tax please follow the application process.

The required information is Taxpayer ID Type Taxpayer ID and Exempt Sales Account Number. Use Tax Exemption on Vehicle Title Transfers. Contractor must provide Michigan Sales and Use Tax Contractor Eligibility Statement Form 3520.

Determine whether the transaction is subject to Michigan sales or use tax. DO NOT send to the Department of Treasury. Showing the tax on the invoice form 5078.

Michigan Department of Treasury 3372 Rev. Both of these documents are required to be completed for the retailer selling the materials to the contractor to keep in their files. Direct collection from customer or.

Sales tax of 6 on their retail. Several examples of exemptions to the states. Michigan Instructions for completing Michigan Sales and Use Tax Certicate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualied transactions.

If so collect tax by. How to fill out the Michigan Sales and Use Tax Certificate of Exemption Form 3372 Filling out the 3372 is pretty straightforward but is critical for the seller to gather all the information. Instructions for Michigan Vehicle Dealers Collecting Sales Tax from Buyers who will Register and Title their Vehicle in Another State or Country.

Register for Sales Tax if you. Ad Sales Tax Exemption Michigan Wholesale License Reseller Permit Businesses Registration. Michigan is a member of the Streamlined Sales and Use Tax Agreement an interstate consortium with the goal of making compliance with sales taxes as simple as possible in member states.

It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed. For Resale at Wholesale. 3372 Michigan Sales and Use Tax Certificate of Exemption Author.

Retailers - Retailers make sales to the final consumer. Sell tangible personal property to the end user from a Michigan location wholesalers do not need to register. These exempt sales must not involve property used in commercial enterprises.

Church Government Entity Nonprot School or Nonprot Hospital Circle type of organization. Instead complete Form 2271 Concessionaires Sales Tax Return and. Once you have that you are eligible to issue a resale certificate.

Sellers should not accept a number as evidence of exemption from sales or use tax. An application for a sales tax license may be obtained on our web site. The certificate that qualifying agricultural producers organizations and other exempt entities may use is the Michigan Sales and Use Tax Certificate of Exemption or form 3372.

This page discusses various sales tax exemptions in Michigan. Michigan Sales and Use Tax Certificate of Exemption. Michigan Department of Treasury Subject.

Churches Sales to organized churches or houses of religious worship are exempt from sales tax. Sales Tax Return for Special Events. 3372 Michigan Sales and Use Tax Certificate of Exemption.

Sales Use and Withholding Tax Due Dates for Holidays and Weekends. The exemption certificate is 3372 Michigan Sales and Use Tax Certificate of Exemption. Notice of New Sales Tax Requirements for Out-of-State Sellers For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the General Sales Tax Act MCL 20552b and Use Tax Act.

Sales Use and Withholding Tax Due Dates for Holidays and Weekends. Banks government entities and companies can use your Michigan tax ID number to identify your business. Sales Tax Exemption Michigan Simple Online Application.

In Michigan certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. A purchaser who claims exemption for resale at retail or for lease must provide the seller with an exemption certifi cate and their sales tax license number or use tax registration number. Producers will note on item 4 in section 3 that you are to indicate the percentage of the purchase item is for agricultural production and that percentage would be exempt from sales tax.

Verification of tax-exempt resale certificate can be carried out through the official Alabama State website. At month end prepare Michigan sales and use tax report and forward to the Financial Operations by the 8th calendar day of the following month Appendix B. Before you can request a Michigan tax ID number for your business you will need to acquire an EIN from the IRS.

This license will furnish a business with a unique Sales Tax Number otherwise referred to as a Sales Tax ID number. Sales Tax Return for Special Events. 09-18 Michigan Sales and Use Tax Certificate of Exemption.

3372 Michigan Sales And Use Tax Certificate Of Exemption. Sales Tax for Concessionaires If you will make retail sales at only one or two events in Michigan per year do not complete Form 518. Obtain a Michigan Sales Tax License.

Certificate must be retained in the sellers records. If audited the Michigan Department of Treasury requires the seller to have a correctly filled out Form 3372. Michigan Sales and Use Tax Certificate of Exemption.

To claim exemption from Michigan sales or use tax that contractor must provide a completed Form 3372 Michigan Sales and Use Tax Certificate of Exemption and provide a copy of Form 3520 that you received from your customer.

Tax Exemption Google Search State Tax Tax Exemption Agreement Quote

Do International Sellers Have To Deal With Sales Tax In The Us Sales Tax Tax Seller

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

Abbyy Coupon Codes Up To 65 Discount Promo Code 2016 Coupons Coupon Codes Coding

Michigan Bill Would Allow Expecting Parents To Claim Fetuses As Income Tax Exemptions Tax Preparation Free Workout Routines Tax Credits

Taxjar Coupon Codes 50 Off Taxjar Com Discount Promo Codes Sales Tax Tax Online Seller

Texas Solar Incentives Resources Dean Solar In 2021 Free Solar Energy Free Solar Solar

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Dutch Winterfest Christmas Holiday Events In Holland Michigan Winterfest Holiday Festival Holidays And Events

Michigan Sales And Use Tax Certificate Of Exemption Students Sae

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Michigan Sales Tax Small Business Guide Truic

Irs 2020 Tax Tables Deductions Exemptions Purposeful Finance Tax Table Irs Taxes Tax Brackets

Pin By Uss Emanuel On James R Barker Ship Barker Basketball Court

Michigan Sales And Use Tax Certificate Of Exemption

Always Hire A Certified Professional Mover Professional Movers Trust Yourself Moving And Storage